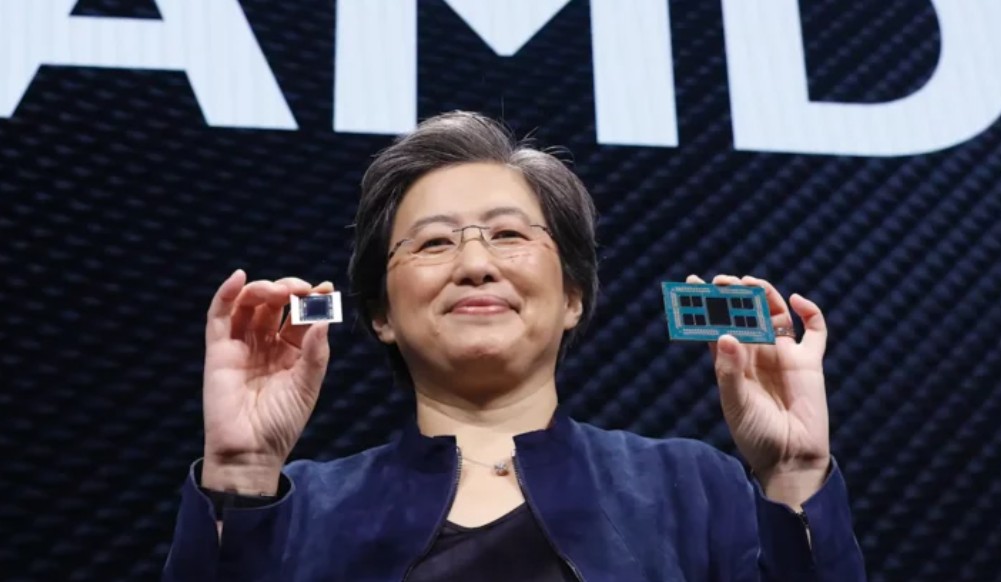

In a significant development that has sent ripples through the tech industry, Advanced Micro Devices (AMD) has disclosed that it expects to incur charges of up to $800 million due to new US export restrictions on advanced processors to China. This move by the Trump administration has not only financial implications for AMD but also highlights the broader geopolitical tensions between the US and China in the semiconductor sector.

The Financial Fallout

AMD’s financial warning, filed with the Securities and Exchange Commission (SEC), details the potential $800 million impact related to inventory write-downs, purchase commitments, and related reserves. This financial blow comes at a time when the company had been reporting record revenues, with China contributing over 24% of its 2024 revenue. The export restrictions specifically target AMD’s MI308 products, which are crucial for high-performance computing and artificial intelligence applications.

Broader Industry Impact

The new licensing requirements are part of a broader US strategy to curb advanced semiconductor exports to China, aiming to limit access to technology critical for military and surveillance applications. This move has also affected AMD’s larger rival, Nvidia, which disclosed a $5.5 billion quarterly charge related to its H20 graphics processing units. Both companies face uncertainty in obtaining export licenses, which could further disrupt their operations and financial performance.

Market Reactions

The announcement led to a significant drop in AMD’s stock price, falling over 7% in trading. The broader tech industry also felt the impact, with semiconductor stocks such as Broadcom and Micron experiencing declines, and the PHLX Semiconductor Index (SOX) dropping 4%. This downturn reflects the market’s sensitivity to geopolitical tensions and the potential for further disruptions in the semiconductor supply chain.

Future Outlook

As AMD and other tech companies navigate these new restrictions, the future remains uncertain. While AMD plans to apply for export licenses, there is no assurance that these requests will be approved. This uncertainty could lead to further financial hits and a slowdown in the global AI hardware market. The situation underscores the delicate balance tech giants must maintain in a global market increasingly shaped by geopolitical tensions.

Conclusion

The $800 million impact on AMD due to US export restrictions on China highlights the far-reaching consequences of geopolitical tensions in the tech industry. As companies like AMD and Nvidia grapple with these challenges, the future of the semiconductor industry remains uncertain. The ability to navigate these restrictions and maintain market momentum will be crucial for these tech giants as they look to the future.